GGA Approach for collections

GGA Approach for collections

Our debtor collections process is about reducing the debtors of an organization in a specific frame without disrupting the client’s internal current processes and systems.

The GGA approach is based on working with the clients and their customers to ensure the timely payment from customers – we believe that the customer pays the client, who calls more often – have to build “payment release recall” and that customers never proactively inform the issue that they have with the invoice:

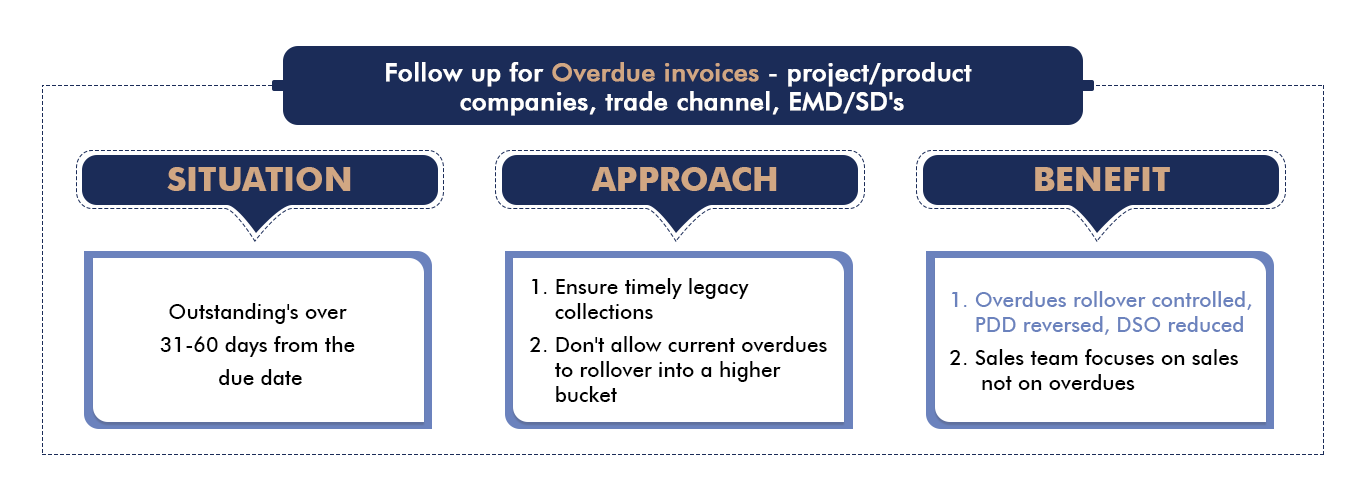

Post approaching the customers via email / phone / visits to their offices, GGA conducts a systematic analysis to identify the reasons for blocked cash and high levels of debtors. We aim to ensure that the disputes raised by the clients are solved at the earliest and debtors collected at the earliest, so that the DSO / Debtors ageing of the company is maintained at the desired levels.

Situations Where GGA Can Help

We're experienced professionals when it comes to assisting B2B companies in debt collection and increasing the profitability of the company. To that effect, many notable companies from a variety of sectors have enlisted our services and gained a host of benefits in the process, such as reduced operating costs and improved cash flow. There are two kinds of situations under which GGA steps in:

Our teams use the following approach for collections:

- Belief – we believe that all customers want to pay – but are facing commercial / service / process issues, that need to be addressed, before they will make the payment

- Relationship – we build relationships with the accounting person responsible for releasing the payment, as they can tell us the status of the invoice and where it is stuck in the workflow etc.

- Analytical – we want to identify the root cause for customers not paying and provide a solution

- Process improvements – highlight processes that lead to trapped cash = improvements

- Classification of customers, after initial contact

- Willing to pay , but facing issues – get the issues solved and then push for payments, promise to pay, making them live upto their payment commitments

- Have already paid / settled – get the proof of payments, in case of settlements – seek further details, emails

- Willing to pay but liquidity issues – get the management approval for staggered payments, PDC’s etc

- No intention to pay – (have defaulted on commitments / not responsive etc) – suggest legal action

Want to Discuss Your Outsourcing Needs?